1. BASIC KNOWLEDGE OF COVERED WARRANT (CW)

-

Is a type of securities with collaterals ensured by issuers, allowing investors the rights to buy or to sell underlying assets at a specific price on a specific date in the future, or to settle the difference between strike price and reference price of the underlying assets on the exercised date.

-

Underlying assets can be stocks, indexes or ETF set by the State Securities Commission of Vietnam (SSC) and the authorized Stock exchange.

-

Covered warrants are listed in the Stock exchange with trading tickers in accordance with regulations from the exchange. Covered warrants are traded similarly to that of stock trading.

-

In the world, there are 02 (two) styles of covered warrant, European style (exercised only on the maturity date) and American style (can be exercised any time before or on the maturity date)

2. WHAT TYPE OF COVERED WARRANT IS BEING TRADED IN THE VIETNAMESE MARKET?

-

Call - Covered Warrants are being listed & traded on the HSX.

-

Underlying assets are stocks within the VN30 index regulated by the exchange & the only style allowed at the moment is European style.

Covered Warrant basic information

|

Category

|

Meaning

|

Example

|

|

Underlying asset

|

Tickers are prescribed by HSX

|

FPT stock

|

|

Conversion rate

|

The numbers of Covered Warrant that can be converted to 01 (one) share

|

4:1 – means that 4 CWs are exchanged into 1 common stock

|

|

Premium price

|

The total investment that is paid by investors to own CW

|

VND 1.000 /1 CW

|

|

Exercise/Strike Price

|

Strike price is the agreed price investors would need to pay for on expiration date (date of maturity). It is used to calculate profit/loss on that date.

|

VND 60.000

|

|

Covered warrant life time

|

The effective life span of CW

|

03 months

|

|

Last trading day

|

-

2 days before the expiration date of CW

-

After that day, CW is delisted

|

(Assume the listed date is on June 26 2019)

September 23 2019

|

|

Reference price

|

Is calculated as the Average of 5 consecutive trading days right before the expiration date of CW.

|

VND 80.000

|

|

Payment method of settlement

|

By cash

|

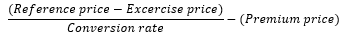

(VND 80.000 – VND 60.000)/4 – VND 1.000

= VND 4.000

|

|

Method of trading

|

Buy/sell CW is similar to trading of stocks. Waiting time for cash to return is on T+2, similar to common stock.

|

|

Moneyness of a Covered Warrant

Call-CW includes:

-

In the money

-

At the Money

-

Out of the Money

CW’s Equation:

Investors receives cash when his/her moneyness is “in the money”. In the situation of “at the money” or “out of the money”, no settlement will be paid out.

Factors affecting the price of a Covered Warrant

-

Stock price

-

Exercise price

-

Time to Expiration

-

Volatility

-

IR

Example:

|

Factors

|

Status

|

Value of call-CW

|

-

Stock price

|

Up trend

|

Up trend

|

-

Exercise price

|

Up trend

|

Down trend

|

-

Time to Expiration

|

Up trend

|

Up trend

|

-

Volatility

|

Up trend

|

Up trend

|

-

IR

|

Up trend

|

Up trend

|

Advantages of CW